Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Silver mine production peaked in 2016 at 900.1 million ounces (27,996 tonnes), according to data from Metals Focus and the Silver Institute. Since then, mine output has declined, with 2024 production projected at 837.3 million ounces, a 7% drop from the 2016 peak. Due to lower silver prices in the past decade, investments into new silver mines is limited.

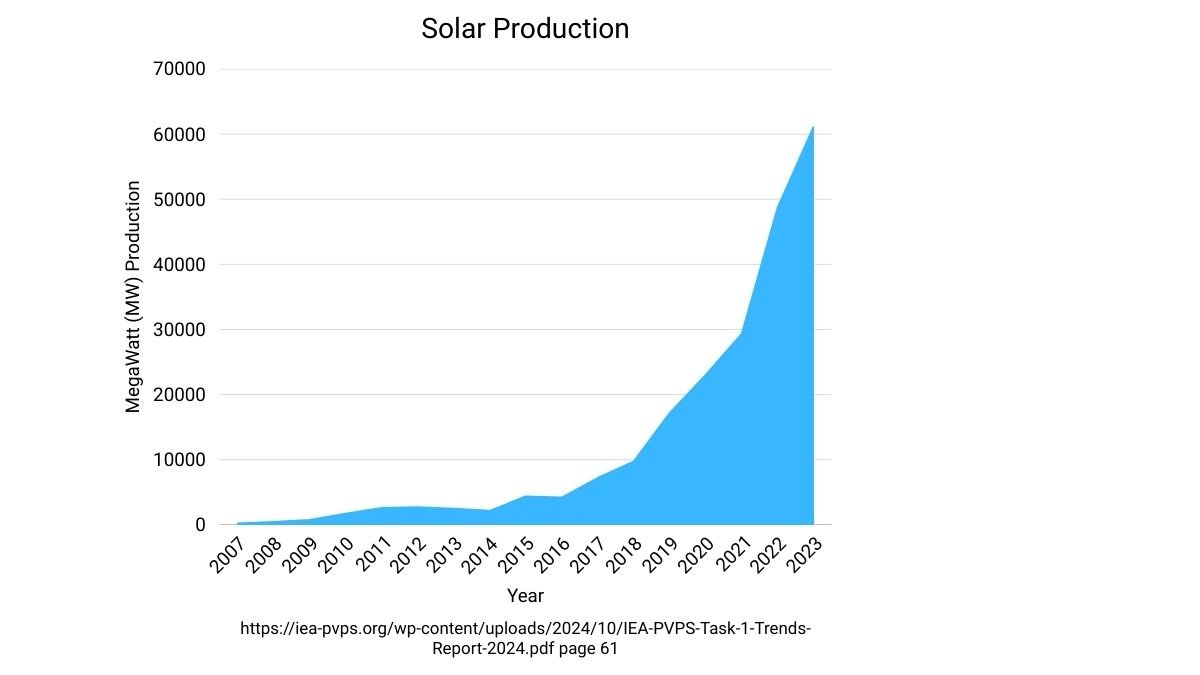

Industrial demand, particularly for solar panels, has been a key driver of deficits. In 2024, industrial demand reached a record 680.5 million ounces, with solar energy applications consuming around 16-19% of total silver demand (approximately 193.5 million ounces in 2023). By 2027, solar panel production could require over 20% of annual silver supply, and by 2050, it may consume 85-98% of current global silver reserves if trends continue.

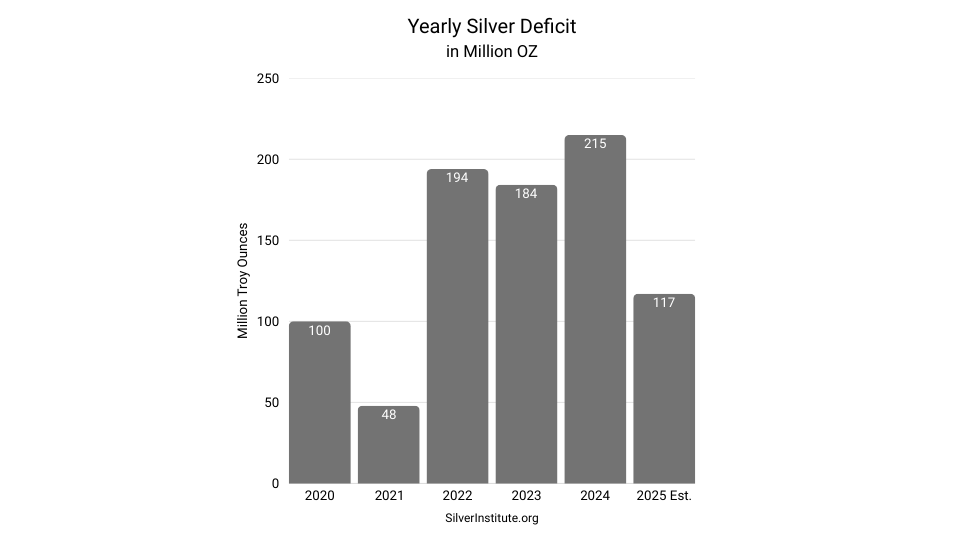

Data Source: The Silver Institute’s World Silver Survey 2023 and Global Silver Demand Forecast for 2024 provide these figures. https://silverinstitute.org/

Emerging technologies, particularly solid-state batteries for electric vehicles (EVs), are poised to dramatically increase silver demand, potentially reshaping the global silver market. Innovations like Samsung’s solid-state battery, which uses a silver-carbon (Ag-C) composite anode, promise a 600-mile range, 9-minute charging time, and a 20-year lifespan, with each 100 kWh battery pack requiring approximately 1 kilogram (32 ounces) of silver—over 600% more than the 5 grams used in current EV batteries. The lightweight design of these batteries, enabled by their high energy density of 500 Wh/kg (nearly double that of conventional lithium-ion batteries), allows for lighter vehicles, extended range, and reduced costs over time, making EVs more cost-attractive and likely to capture a larger market share. If just 20% of the 80 million vehicles produced annually adopt this technology by 2030, silver demand could surge by 16,000 metric tons—equivalent to 64% of current global silver production (25,660 metric tons). While these advancements could drive silver prices higher, challenges like production costs, charging infrastructure, and potential competing technologies (e.g., graphene batteries) may temper adoption timelines.

Silver recycling plays a vital role in supplementing the global silver supply, contributing approximately 200 million ounces annually to the market, primarily from industrial scrap, jewelry, and silverware. However, this recycled supply falls short of meeting the rapidly growing demand, which reached 1,195 million ounces in 2023 and is projected to hit 1,302 million ounces in 2024, according to the Silver Institute. The surge in demand, driven largely by industrial applications like solar panels (consuming 193.5 million ounces in 2023) and electronics, has outpaced both mined production (837 million ounces in 2023) and recycling efforts, leading to a structural deficit of 678 million ounces from 2021 to 2024. While recycling mitigates some pressure on dwindling above-ground stocks, it cannot keep up with the accelerating consumption, particularly in green energy sectors, exacerbating concerns about silver scarcity.

The global silver market has faced a persistent structural deficit, averaging approximately 135.6 million ounces per year over the past five years (with a projected 117.6 million ounce deficit in 2025), according to the Silver Institute’s World Silver Survey 2025. This shortfall is driven by soaring demand, particularly from solar panel production (193.5 million ounces in 2023) and the electrifying wave of technologies like solid-state batteries, which could consume significant silver quantities as electric vehicles gain market share. With industrial demand projected to grow further—potentially exceeding 20% of annual silver supply for photovoltaics alone by 2027—these deficits are set to widen. Compounding this, Keith Neumeyer, CEO of First Majestic Silver, recently noted in an interview that bringing a new silver mine online in North America takes 18 years due to regulatory and logistical hurdles, making significant supply increases unlikely in the near term. As above-ground silver stocks dwindle, with a reported 5% inventory decline in 2023, the market faces mounting pressure.

Stay tuned for our next article, where we’ll explore the timelines for when above-ground silver supplies may reach critical stress points under this relentless demand and how long these reserves might last. “When Will the Silver Deficit Deplete Above-Ground Stocks“

Sources:

The Silver Institute. (2023). World Silver Survey 2023. Retrieved July 13, 2025, from https://www.silverinstitute.org

The Silver Institute. (2024). Global Silver Demand Forecast for 2024. Retrieved July 13, 2025, from https://www.silverinstitute.org

The Silver Institute. (2025). World Silver Survey 2025. Retrieved July 13, 2025, from https://www.silverinstitute.org

The Silver Institute. (2025). Global Silver Market Forecast for 2025. Retrieved July 13, 2025, from https://www.silverinstitute.org

MINING.COM. (2023, April 24). Silver market fundamentals strong as it enters a new era of supply deficits. Retrieved July 13, 2025, from https://www.mining.com

MINING.COM. (2024, April 17). Global silver deficit to rise in 2024. Retrieved July 13, 2025, from https://www.mining.com

MINING.COM. (2025, April 16). Lower silver demand and higher supply to reduce global deficit by 21% in 2025. Retrieved July 13, 2025, from https://www.mining.com

MoneyMetals.com. (2024, October 4). Silver miners struggle to keep up with demand. Retrieved July 13, 2025, from https://www.moneymetals.com

MoneyMetals.com. (2025, April 17). Silver Market Records Fourth Straight Supply Deficit. Retrieved July 13, 2025, from https://www.moneymetals.com

MoneyMetals.com. (2025, April 25). Keith Neumeyer: Silver’s Supply Crisis and the Coming Price Surge. Retrieved July 13, 2025, from https://www.moneymetals.com

MoneyMetals.com. (2025, May 13). Review: World Silver Survey 2025. Retrieved July 13, 2025, from https://www.moneymetals.com

Fantastic article. Great information. I’m long on silver since 2012!

you’re too ahead of your time!