Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

As silver enthusiasts with over a decade of experience in the precious metals space, we’ve learned that buying silver is both an exciting and nuanced process. While it may seem straightforward, the multitude of choices—brands, sizes, rounds versus bars, or whether to buy incrementally or in bulk—can leave your shopping cart abandoned for days as you mull over options. Then, weeks later, you hear silver is up 20%+ for the year, and that forgotten cart becomes a missed opportunity.

This guide is designed to give you the confidence to make informed decisions before you shop, ensuring you get the most silver for your dollar. Every silver bug has their favorite retailers, and our insights come from firsthand experience in the silver community. In this article, we’ll cover: reputable online bullion dealers trusted by the community, the cost differences between generic and premium silver like American Silver Eagles, payment method impacts (credit card/PayPal vs. bank wire), tiered pricing structures for bulk purchases, and the perk of free shipping on orders over $199.

When buying silver, choosing a trusted dealer is critical to ensure authenticity and fair pricing. Based on our decade in the silver community, several online bullion dealers have earned reputations for reliability and engagement with collectors and investors. JM Bullion, established in 2011, is a favorite for its transparent pricing, wide selection of rounds, bars, and coins, and consistent interaction with the community through educational resources. APMEX (American Precious Metals Exchange), operating since 2000, is another heavyweight, known for its vast inventory and strong customer service, including a robust buy-back program. SD Bullion, founded in 2012, has gained traction for competitive pricing and a focus on low premiums, especially for bulk buyers. Provident Metals, with over a decade in the industry, is praised for its user-friendly platform and frequent promotions. These dealers have built trust through years of consistent service, secure shipping, and active participation in the silver community. While preferences vary among silver bugs, these retailers are widely respected for their longevity and reliability. (Not Sponsored)

Not all silver is priced equally, and understanding the cost spectrum can maximize your investment. Generic silver, such as 1-ounce rounds or 10-ounce bars from reputable private mints like Sunshine Mint or Silvertowne, often carries the lowest premiums, sometimes as little as $2–$3 over the spot price per ounce. These are ideal for stackers prioritizing quantity over collectibility. In contrast, premium products like American Silver Eagles, minted by the U.S. Mint, command higher premiums—often $8–$12 over spot—due to their government-backed purity, iconic design, and collectible appeal. For example, at a spot price of $40 per ounce, a generic round might cost $43, while an American Silver Eagle could be $48–$52. While Eagles offer liquidity and prestige, generic silver delivers more ounces for your budget. Your choice depends on whether you’re stacking for weight or investing in recognizable coins with potential numismatic value.

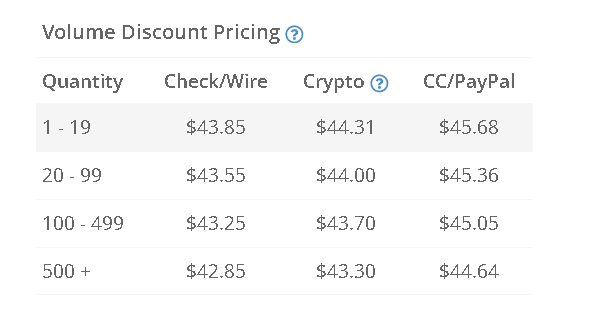

Payment method can significantly impact your cost per ounce. Most dealers charge a premium for credit card or PayPal payments—typically around 4%—to cover processing fees. For example, a 1-ounce silver round priced at $43.85 via bank wire might cost $45.68 with a credit card or PayPal, a $1.83 difference per ounce. For a 100-ounce purchase, that’s $183 in savings with a wire transfer. However, bank wires often incur a fee, typically $15–$25, depending on your bank. If you’re buying smaller quantities, like 10 ounces, the wire fee might offset the savings, making credit card or PayPal more practical. For larger purchases, the 4% savings usually outweighs the wire fee. Check with your bank and dealer to weigh the cost-benefit, especially if you’re aiming to stretch your dollar.

Another way to save is by leveraging tiered pricing, where dealers offer lower prices per ounce for larger quantities. For instance, buying 1–19 ounces of silver might cost $45.68 per ounce, but purchasing 100–499 ounces could drop the price to $45.05 per ounce—a $0.63 savings per ounce. On a 100-ounce order, that’s $63 saved. Some dealers even offer deeper discounts for quantities like 500+ ounces. This structure rewards bulk buyers, so if your budget allows, consider consolidating purchases to hit a lower pricing tier. However, always balance this against storage and security concerns, as larger stacks require safe storage solutions.

Most reputable dealers, like JM Bullion, APMEX, and SD Bullion, offer free shipping on orders exceeding $199, which can further reduce your cost per ounce. For example, if shipping costs $10–$20 for smaller orders, hitting the $199 threshold eliminates that expense. At a silver price of $45 per ounce, $199 equates to roughly 4–5 ounces, a modest purchase for most stackers. By planning your buys to meet this threshold, you avoid shipping fees, which can add up over multiple small orders. Combine this with tiered pricing and bank wire payments for maximum savings.

Visiting a local coin shop is a great way to buy silver while maximizing your dollar. These shops often offer competitive pricing and unique deals on coins, rounds, or bars not always found online, and you can inspect the silver in person before purchasing. Shopping locally also connects you with the silver community, allowing you to meet fellow enthusiasts and gain insights from experienced dealers who often share market tips. Additionally, selling silver to a local shop is straightforward—you can walk in, accept their offer, and leave with a check immediately, avoiding the hassle of shipping to an online retailer and waiting for a quote that might not meet your expectations. As with any major purchase, be sure to read online reviews of the coin shop to ensure it has a solid reputation for fair pricing and trustworthy service.

If you’d like to read about the silver shortage timeframe of above-ground stocks, check out “When Will the Silver Deficit Deplete Above-Ground Stocks“

Give US YOUR FAVORITES

This guide has equipped you with the tools to buy silver confidently, ensuring you get the most for your dollar. We’ve explored trusted online bullion dealers like JM Bullion and APMEX, the cost differences between generic silver and premium American Silver Eagles, savings from choosing bank wire over credit card/PayPal, leveraging tiered pricing for bulk buys, securing free shipping on orders over $199, and the benefits of shopping at local coin shops to connect with the silver community and simplify selling. Every silver bug has a favorite dealer, and we’d love to hear yours! Comment below with your most beloved bullion dealer, local or online, and we might compile a list of all recommended dealers to share with the community!